Investing in the stock market can seem daunting, especially for those new to the world of investing. However, with the right knowledge and tools, investing in the stock market can be an effective way to grow wealth over the long-term. In this article, we’ll discuss some of the best brokers in India for investing in the stock market.

We all want to achieve financial success and security, but it can be overwhelming to know where to start. In this post, we’ll discuss five proven strategies for wealth creation and management that you can start implementing today in an Indian context.

Strategy 1 – Start Early and Invest Consistently

One of the most effective ways to build wealth over time is to start early and invest consistently. The power of compounding means that even small investments can grow significantly over the long term. For example, if you invest ₹5,000 per month for 30 years and earn an average annual return of 12%, you could end up with over ₹5.5 crore.

To implement this strategy, start by setting a realistic investment goal based on your income and expenses. Then, commit to investing a certain amount each month or paycheck, even if it’s just a small amount to start with. You can use a robo-advisor or a low-cost brokerage like Zerodha or Groww to help you get started.

Strategy 2 – Diversify Your Portfolio

Diversifying your portfolio is important for managing risk and maximizing returns. Instead of putting all your money in one stock or asset class, you should spread your investments across different types of assets, such as stocks, bonds, and gold.

To achieve a diversified portfolio, consider investing in low-cost index funds or exchange-traded funds (ETFs) that provide exposure to different markets and asset classes. You can also invest in gold through gold ETFs or sovereign gold bonds.

Strategy 3 – Reduce Debt and Save for Emergencies

Reducing debt and saving for emergencies is important for long-term financial stability. High-interest debt, such as credit card debt, can quickly accumulate and hinder your ability to save and invest. Similarly, unexpected expenses, such as car repairs or medical bills, can derail your financial plans if you don’t have an emergency fund.

To implement this strategy, start by paying off high-interest debt using the debt snowball or debt avalanche method. Once you’ve paid off your debt, start building an emergency fund that covers 3-6 months of living expenses. You can use a high-yield savings account or a liquid fund for this purpose.

Strategy 4 – Use Tax-Advantaged Accounts

Using tax-advantaged accounts, such as Provident Fund (PF) and National Pension System (NPS), for retirement savings can help you save more money and reduce your tax burden. These accounts allow you to invest pre-tax or post-tax dollars, depending on the account type, and grow your investments tax-free until you withdraw the money in retirement.

To implement this strategy, start by contributing to your employer-sponsored Provident Fund account, if available, up to the maximum amount allowed. You can also consider opening an individual National Pension System (NPS) account if you want more investment options.

Strategy 5 – Invest in a Low-Cost Index Fund

Investing in a low-cost index fund is a simple and effective way to invest in the stock market. Instead of trying to pick individual stocks, index funds provide exposure to an entire market or asset class, such as the Nifty 50 or the total stock market.

To implement this strategy, consider investing in a low-cost index fund like HDFC Index Fund Nifty 50 Plan or Nippon India Index Fund Nifty Plan. These funds provide exposure to the entire Indian stock market, with low expenses and broad diversification. To invest in these funds, open a brokerage account with HDFC Securities, ICICI Direct or another reputable broker, fund your account, and buy shares of the fund using the available funds

Here’s some additional information and the mobile application links of the mentioned brokers:

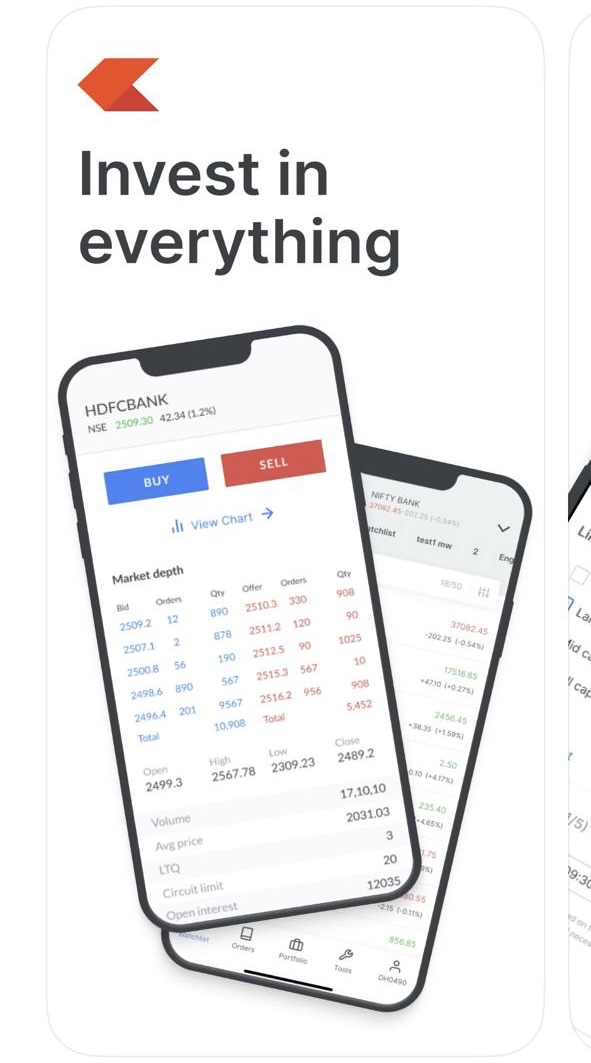

Zerodha – Zerodha is a leading discount brokerage firm in India, offering low-cost trading and investment services. The brokerage charges zero brokerage fees for equity delivery trades, and a flat rate of ₹20 per trade for other types of trades. They also offer a range of investment options, including mutual funds, stocks, bonds, and more.

Mobile App Links:

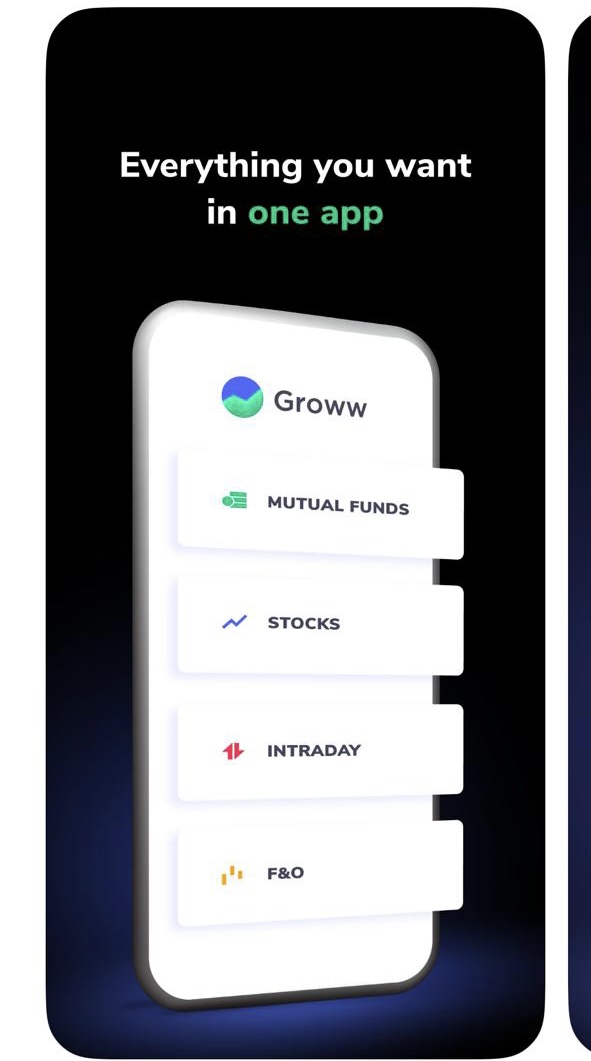

Groww – Groww is another popular investment platform in India, offering commission-free investing in stocks, mutual funds, and more. They also offer a range of educational resources and tools to help investors make informed investment decisions.

Mobile App Links:

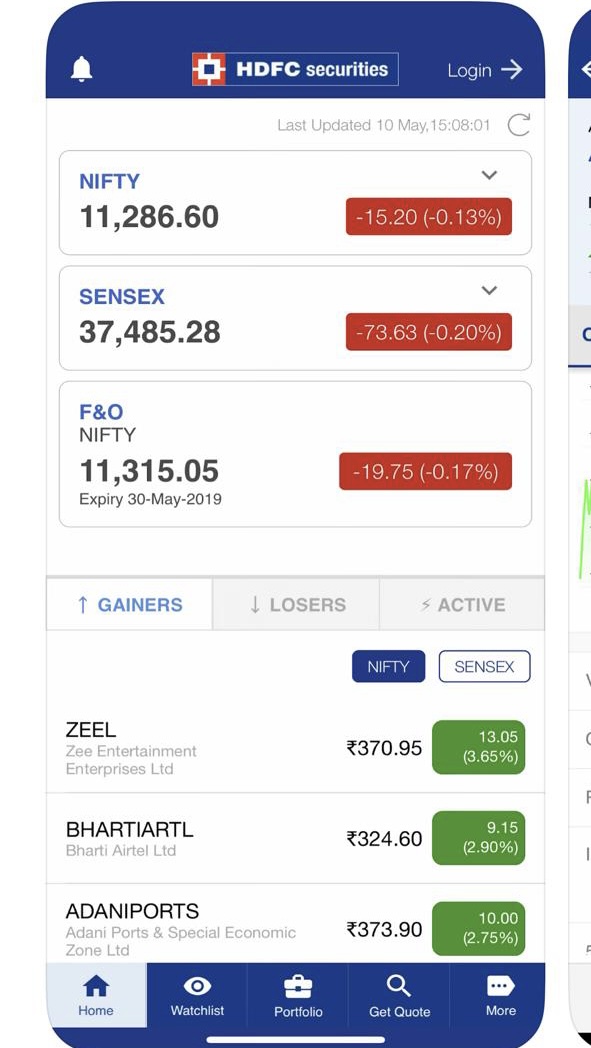

HDFC Securities – HDFC Securities is a full-service brokerage firm in India, offering a wide range of investment and trading services. They offer trading in equity, derivatives, currencies, and more, as well as investment in mutual funds, bonds, and other financial instruments.

Mobile App Links:

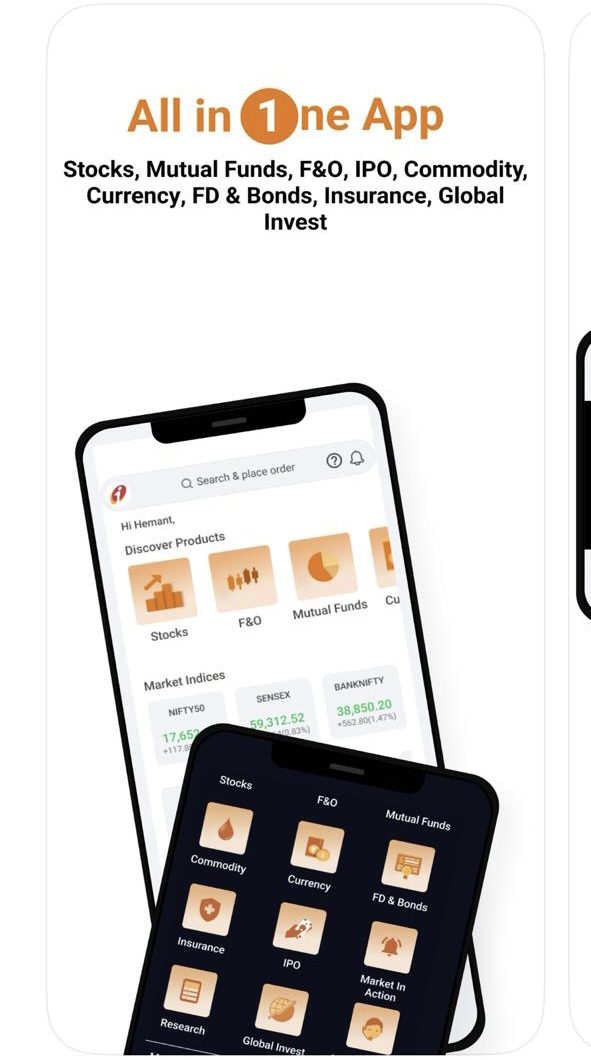

ICICI Direct – ICICI Direct is another full-service brokerage firm in India, offering investment and trading services to retail and institutional customers. They offer trading in equity, derivatives, currencies, and more, as well as investment in mutual funds, bonds, and other financial instruments.

Mobile App Links:

I hope this additional information helps!

While investing in the stock market can offer great returns, it’s important to keep in mind that all investments come with a certain level of risk. The stock market is known for its volatility and unpredictability, and there is always the potential for losses as well as gains. It’s important for investors to do their due diligence, understand the risks involved with their investments, and create a diversified portfolio to help manage risk. Additionally, it’s important to avoid making impulsive decisions based on short-term market fluctuations and to maintain a long-term investment strategy. By being aware of the risks involved and taking a measured approach to investing, investors can help protect themselves from significant losses and increase their chances of long-term investment success.

Investing in the stock market can be a great way to build wealth over the long-term, but it’s important to do so through a reliable and trustworthy broker. Each of the brokers mentioned in this article offer a range of investment options, user-friendly platforms, and affordable fees, making them great options for new and experienced investors alike. By doing your research and finding the right broker for your investment goals and risk tolerance, you can be well on your way to building wealth in the stock market.

Comments are closed.